Being able to predict a leader’s behavior, situational performance, ability to motivate staff, and ethical compass can only improve investing success. Are you sick and tired of hotshot CEOs who end up ruining a company and its stock price? Are you sick and tired of losing your investment?

Nothing makes for a worse day than a 20% decline. Get insights, analyze, and predict behavioral patterns for a company’s leaders. Know how the company will perform. A company’s success isn’t just about financials and strategies. Instead, it is about how they think and behave. If you want an edge in investing, here is your chance.

Transaction leaders excel in transactional business, while transformational leaders thrive in innovative organizations. Aggressive and combative leaders may experience quick returns, but foster a toxic work environment. Charismatic leaders improve morale and motivate staff, while neurotic leaders diminish morale and impede productivity. Leaders shape a company’s culture, influence stakeholders, and affect a company strategically and financially. Knowing the leader is …

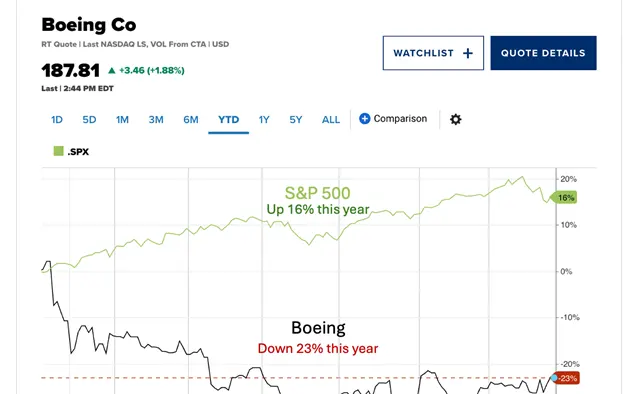

Calhoun did increase Boeing’s stock price for a bit, but Calhoun’s personality and leadership style became too much, and Boeing is suffering. His tenure is marked with deception and quality issues after a door blew out during a flight. Yet, Calhoun managed to triple his salary to $61M while the employees received about 3% in wage increases.

An investment of $1000 in Boeing on January 1, 2024, would be worth $770, while the same investment into Bombardier, a Boeing competitor, would be worth $1,790 – a $1020 difference. The economy and the airline industry were not factors in the performance. Instead, it was the difference in leadership. Thus, knowing the leaders is knowing the future of the company.

Buy and hold, short, or get aggressive with options. Charlie’s Almanack provides the insights to win in your preferred investment approach. See who the winners and losers are, identify a toxic leader before everyone else, and compare your favorite investments to identify the biggest gains.

Predict the person, and you predict the company. Our executive analysis provides a comprehensive assessment to make your own predictions. Additionally, we provide detailed investment strategies to help guide your evaluations. Don’t invest based just on historical performance. Instead, better predict how the stock will do in the future.

See companies side-by-side to evaluate opportunities. Certain sectors have higher growth potential than others, but knowing which company to invest requires knowing how the company will position itself to win. Our industry comparisons highlight the likely winners so you make better investment decisions.

Timing is everything, and knowing how current events and situations will affect a company is vital. Don’t wait to see what happens, our alerts model the likely outcomes so you can invest with confidence or sell before taking a loss. The key is having up-to-date information with recommendations.